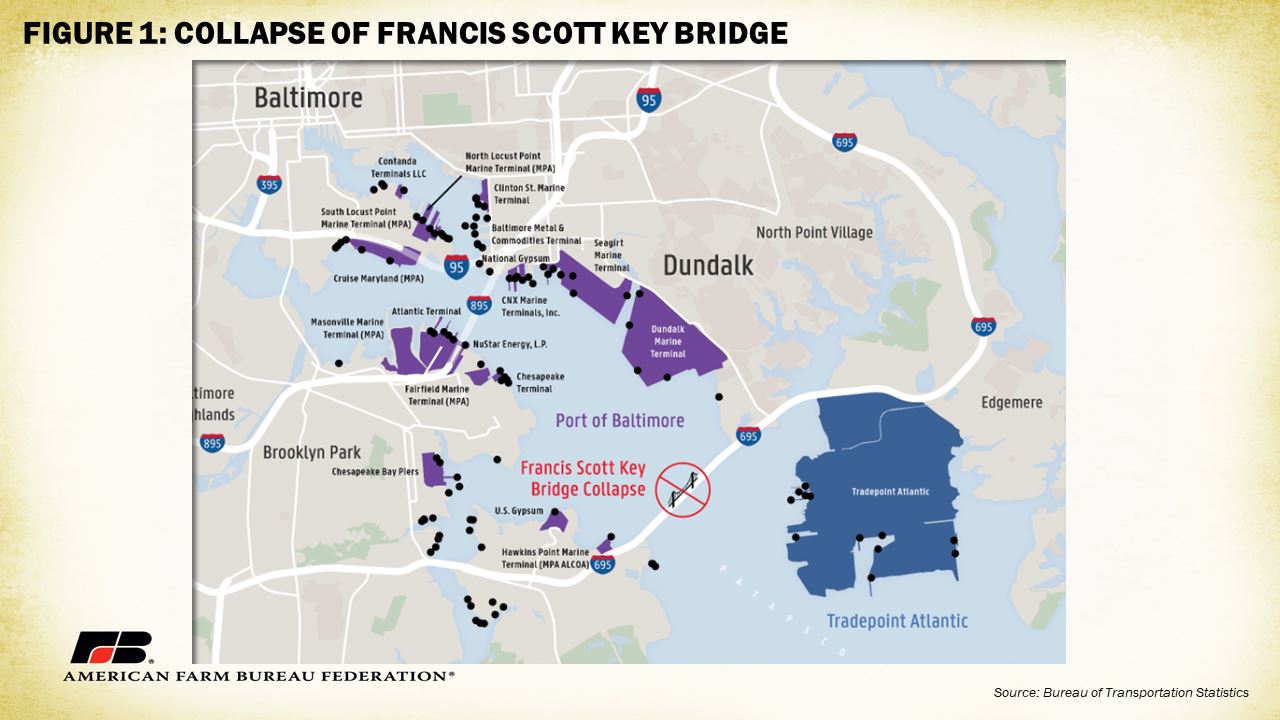

On March 26, a container ship rammed into Baltimore’s Francis Scott Key Bridge resulting in the structure’s collapse and the tragic loss of six construction workers. Aside from the everlasting impacts to the families who lost loved ones, the destroyed bridge has physically cut off key coal, container and automobile terminals at the Port of Baltimore from the outside world.

In 2021, the port’s terminals processed over 37 million short tons of combined import and export product. This ranks the Port of Baltimore No. 17 in terms of cargo throughput in the United States. According to the government of Maryland, the port generates over $3.3 billion in personal income, 15,330 direct jobs and 139,190 related jobs. As the wreckage of the bridge continues to prevent the movement of ships to and from port terminals, negative economic impacts compound.

This article provides an overview of the potential implication of the blockage on agriculture.

USDA’s Global Agricultural Trade System provides data on the quantity and value of agricultural trade to and from certain U.S. customs districts or locations where ag trade enters and leaves the country. Selecting Baltimore allows for the isolation of agricultural trade through Baltimore’s ports. While some product volume likely arrives in Baltimore via air, the vast majority arrives on cargo ships, providing a window into the importance of the Port of Baltimore to agricultural markets.

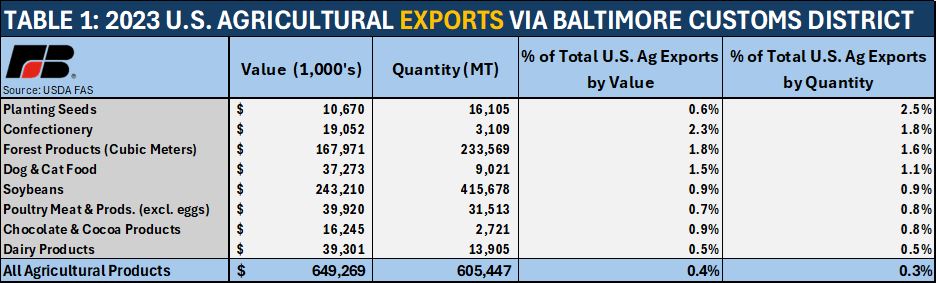

On the export side, in 2023, over 605,000 metric tons (MT) of agricultural products were exported from Baltimore corresponding to nearly $650 million in value (price of products times quantity purchased). This equates to just 0.3 percent of total U.S. ag exports by quantity and 0.4 percent by value.

In terms of volume, 415,678 MT of soybeans were exported from Baltimore in 2023, or 0.9 percent of all U.S. soybean exports, valued at $243 million. Over 230,000 cubic meters of forest products also left the port in 2023, corresponding to 1.6 percent of all U.S. forest product exports valued at $167 million. In terms of quantity exported, the customs district of Baltimore ranks 22nd (out of 43), right behind Mobile, Alabama, and ahead of Ogdensburg, New York. It is important to remember customs districts include some landlocked locations such as El Paso and Laredo in Texas, meaning these comparisons also include railway and truck crossing volumes. In terms of value, the largest export destinations for agricultural products leaving Baltimore were Taiwan, China and Colombia. Note, "all agricultural products" on below charts do not include product volumes measured in units besides metric tons.

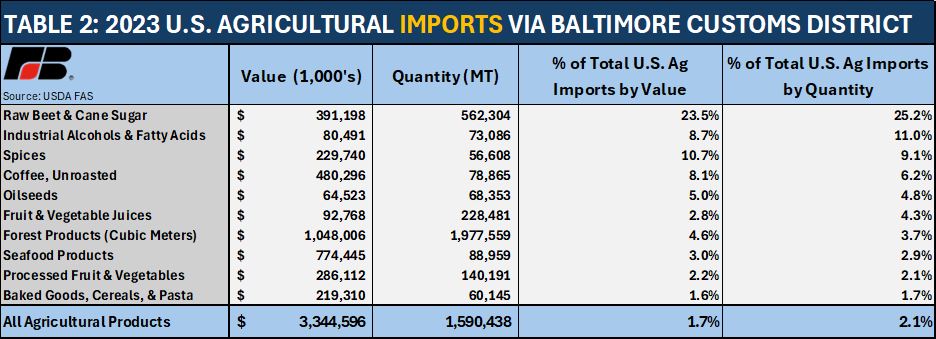

On the import side, in 2023, over 1.59 MT of agricultural products entered though Baltimore, corresponding to nearly $3.34 billion in value. By quantity, over 25 percent of all U.S. imported raw beet and cane sugar entered through Baltimore (562,000 MT valued at $391 million). Over $1 billion in forest products were imported through Baltimore in 2023 (1.98 million cubic meters), 3.7 percent of all imported U.S. forest products. Baltimore also serves as a significant receiver of industrial alcohols and fatty acids (11 percent of U.S. imports), spices (9.1 percent of U.S. imports) and coffee (6.2 percent of U.S. imports). In terms of quantity imported, the customs district of Baltimore ranks 18th (out of 41), right behind Duluth, Minnesota, and ahead of Ogdensburg, New York. The largest import origins for agricultural products entering Baltimore, by value, were Brazil, Indonesia and Spain.

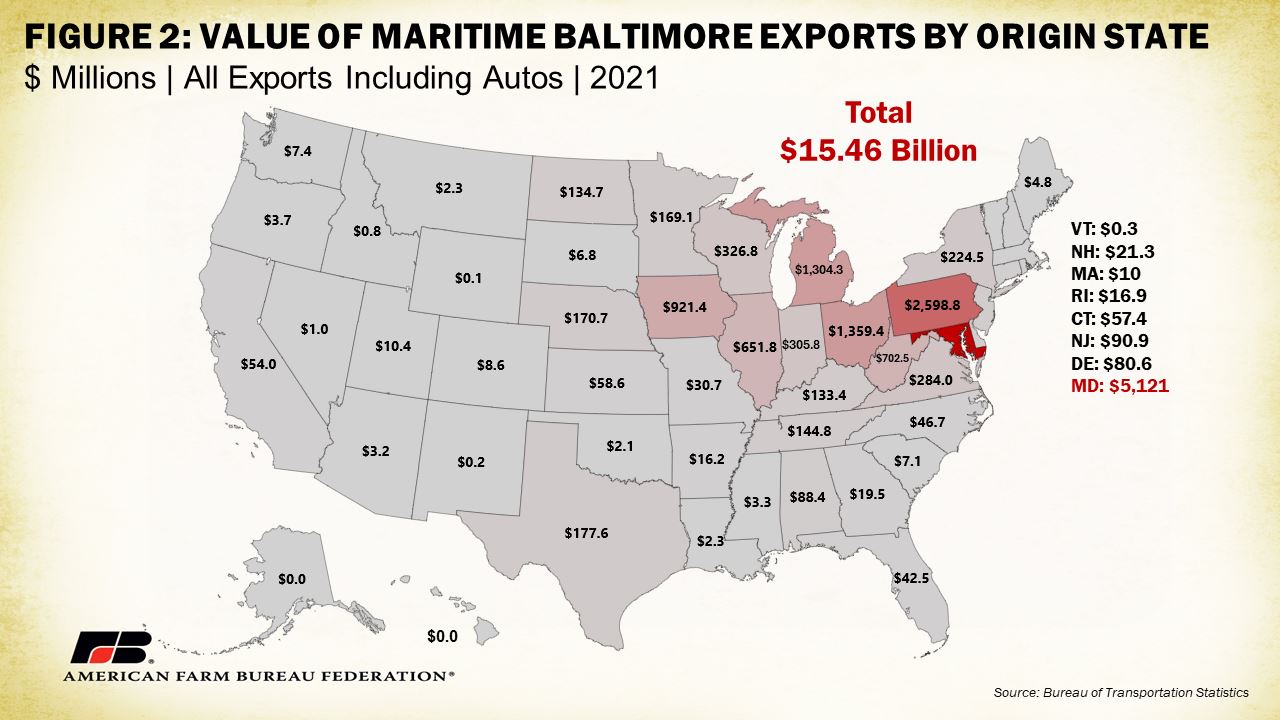

Baltimore has a fairly minor role, comparatively, in U.S. ag trade although its value in providing businesses, including farmers in the region and even across the nation, access to international markets should not be understated. Part of the port’s origins were in fueling the growth of the nation’s nascent ag economy. The central and inland location gave it convenient access to Maryland, central and western Pennsylvania and – by some of the nation’s earliest railways – the Midwest. Today those benefits persist. The Bureau of Transportation Statistics provides cumulative export values of product leaving the Port of Baltimore by origin state (Figure 2). This includes all products, meaning we cannot differentiate only agricultural products. Regardless, states as far away as Washington benefit from the Port of Baltimore with over $7.4 million in export value originating from there. As expected, the closer you get to Maryland, generally, the higher the value goes. Over $1.3 billion in Michigan products leave Baltimore, likely linked to the state’s car manufacturing industry. Until the Port of Baltimore reopens, these businesses will have to find other options to ship product and inbound cargo will have to find alternative locations to unload. Even minor disruptions backlog the broader cargo system that is dependent on containers and ships arriving and departing on schedule.

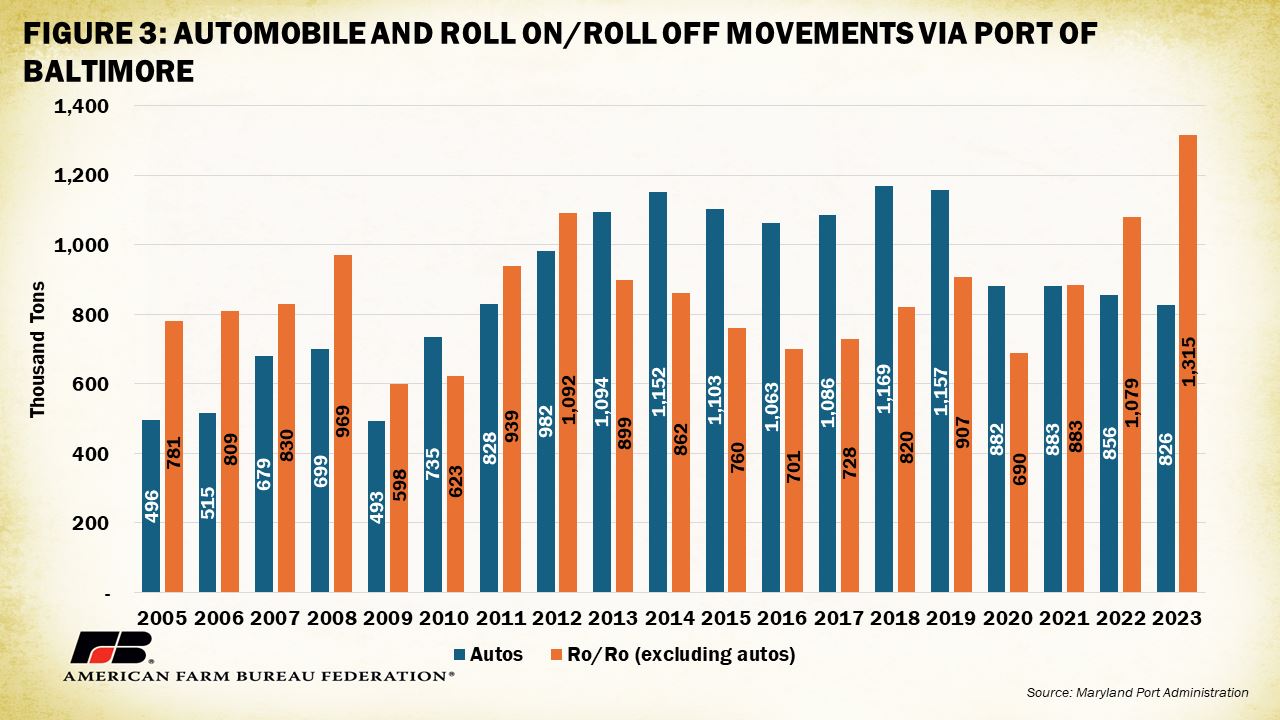

Of all ag-related businesses, sugar refineries appear to be the most exposed to possible negative impacts from the Port’s closure. Nearby refineries, however, have assured customers they had six to eight weeks of raw sugar on hand before operations could potentially be impacted. Ag equipment manufacturers may also face challenges. Roll on/roll off (Ro/Ro) vehicles which includes farm and construction machinery, are common passengers through the Port of Baltimore.

Since 2010, over 600,000 tons of non-automobile Ro/Ro cargo have transited the port each year. Since 2022, the volume of Ro/Ro vehicles has even surpassed automobiles – one of the Ports most served industries (Figure 3). In 2023, over 1.3 million tons of Ro/Ro cargo crossed Baltimore terminals. The inability of farmers, domestically or internationally, to receive equipment they ordered could have a significant impact as spring planting season arrives. The Association of Equipment Manufacturers noted the port is a “very important part of our industry’s ability to ship equipment and equipment components all over the world” but also shared, “it is too early to predict the impact currently.”

Data on the impact to other important inputs, such as fertilizer, is limited. There was one report of a Urea Ammonium Nitrate vessel that was scheduled to unload in Baltimore. It is likely the vessel will be diverted to other nearby ports, perhaps to Chesapeake, Virginia, or Philadelphia. Supply chain issues usually lead to higher prices for goods, and it would not be surprising to see the local price of inputs tick up in response. Most farmers have likely already paid for their fertilizer supply for the year, but for those in the region waiting on shipments, diversions may cause headaches.

Summary

The collapse of Baltimore's Francis Scott Key Bridge following a container ship collision shocked the nation and tragically claimed the lives of six people. Farmers and ranchers across the country joined many others in praying for the families affected. In the aftermath, questions have emerged about the potential impact on agricultural markets. The Port of Baltimore is responsible for moving 0.3 percent of U.S. ag exports and 2.1 percent of imports, meaning its impact on overall U.S. ag trade is quite minor.

Despite its limited role, its significance in providing access to international markets for businesses, including farmers, should not be minimized. Industries reliant on the port, such as sugar refineries and ag equipment manufacturers, appear to face more imminent challenges, while longer term supply chain disruptions may lead to increased prices and logistical hurdles for farmers awaiting inputs.

Thankfully, the global freight network has become accustomed to uncertain shipping conditions, allowing it to adapt effectively to such situations.